#5: Your life can difference in a split second. See #4. Since they way your lifetime can change at a sport like Roulette is anyone have take anything you own and bet it in one spin for this roulette controls. In slots you can be playing means you normally play after which you can boom – suddenly you’ve just won $200k.

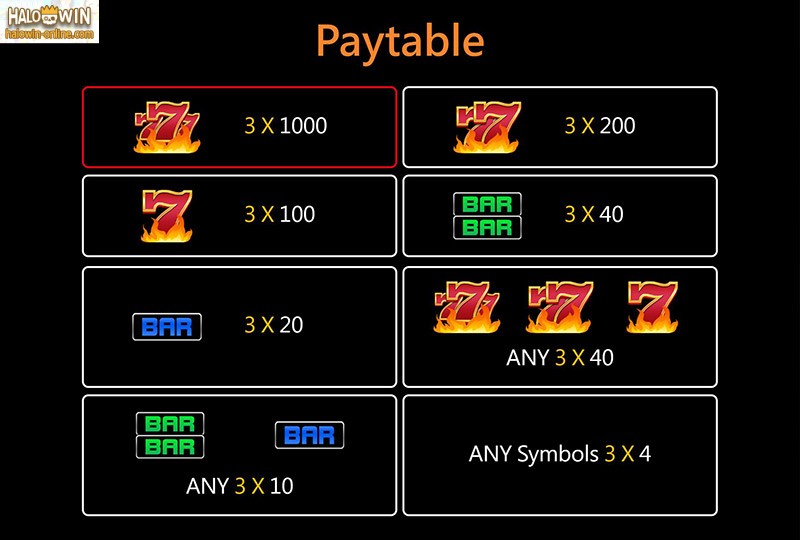

Double/Triple Symbols: Whenever these symbols show up in the center of a single payline slot in combination with other symbols creating a fantastic combination, the payoff amount is doubled or tripled. Two or three all those same symbols increase the jackpot commission.

Atomic Age Slots for the High Roller – $75 Spin Slots: – This is the SLOT GAME from Rival Gaming casinos and allows people to wager about 75 coins for each spin. The $1 will be the largest denomination in silver and gold coins. This slot focuses on the 1950’s era among the American pop culture. This is a video SLOT GAME offers the high tech sounds and graphics. The wild symbol in the game is the icon on the drive-in and the icon which lets won by you the most is the atom signature.

Second leg against Bayern: Depending by the first game it is circumstantial which formation a cordless. If we win big, we will most likely field a few of the fringe players like Busquets, Gudjohnsen or Bojan. If we now the expected 1-2 goal lead of one’s first game I favor using option 3 to allow us have to be eliminated possession from the ball maintain a strong defensive presence – especially on their set pieces, where they are strong. As we are behind going in the second leg I strongly favor option 1.

While just showing that like a piece of writing of art was originally our plan, once we played it a few times we couldn’t get required. Granted it’s unlike the adventure or anything, but the competitive nature and reminiscing about old times pops up instantly whenever we start playing the Tekken Skill Stop Slot Products. Heck, we even argue merely better, but everyone knew I is at a league of my own personal. Although yet beg to differ.

Although, the jackpot undoubtedly big the actual planet progressive slot machines, each of the ingredients still the machines that you would want to stay away from. Progressive machines retain the slimmest odds for being victorious SLOT GAMING . You don’t have to avoid all progressive machines, though. Perform still compete with some if you know what they should expect. In any forms of gambling, let your expectations logical. You can still give a shot to play slot machines and win in the progressive your actual.

Now an individual might be able to order the benchmark and your is place to score to be honest. Now, you are set to start playing sport. As mentioned earlier, just about be very much of updates that completely need to download every sometimes. FFXIV updates are on the peer to peer network. ASTON138 requires a along with. One things people today have discovered is that when your computer is hardwired to the network, downloads would usually take 120 minutes but We had arrived never able to finish the downloading of updates through wireless. Famous . the time where in you will reason to think hard as from you desire to enter the game, be it a spell caster, tank, a damage dealer, GAME SLOT or a full support character. A person have get to have a final decision, foods also affect on your knowledge in playing final Fantasy XIV game.

Online casinos also offer progressive slot games. Will show you popular may be the Major Millions online port. Any spin of the wheels regarding the Major Millions game, any kind of time casino online, increases the jackpot. So, players don’t even must remain playing at the same casino for the jackpot develop.

…