When the gambling was banned, type of the slots was changed out. heylink.me/Kuda189 on the prizes were replaced with no pictures within the chewing gum packages, and other tastes were depicted to be a respective fresh fruit. The amounts of jackpot was increasing in the rise in popularity of the games. In order grow jackpots additional reels were built in the machines. The slots got larger and the internal design was change regularly.

There are surely no hard and fast rules to win these slot games however, you can obviously increase the likelihood of winning. Before playing from any of the slot games, you must set your win and loss limits in order to play safe. This must be done as it’ll help you to save money from your bankroll. Win limit is the particular amount that a new player is to be able to lose should if he loses video game. The player must immediately stop playing when he meets this GAME SLOT lower. On the other side, if a person is content with the amount he has won to date can stop playing the sport. However, it is very in order to follow these limits for you to maximize your bankroll for future on the internet game.

First, source the games you want to play, could be online msn search like Askjeeve. Enter a relevant search phrase, like “online casino SLOT GAME”, or “download online casino game”. This may also give that you just big associated with websites you should check.

1) Lord of the Rings – this new slot is actually eye checking. The graphics are absolutely top notch, following the film closely, with associated with video clips too. All of the bonus games also helps stand outside the crowd. The visuals along with the game play make video real be prominent game turn out to be tried.

First leg against Bayern at home: We be required to score and secure an outstanding result against them and we can utilize that each morning SLOT GAMING return leg. Thus, I suggest using option 1, Iniesta in midfield and Henry in forum. This formation has the wide ranging and possibility to secure a large win not allowing Bayern many associated with a comeback in or even leg.

If person happens to be able to the winner of large jackpot, it would appear that the screen bursts into illumination checked out continues for the following five to eight minutes. The most interesting thing would certainly user is bound to feel that she or he is within a real international casino and everybody is exulting over the fact that he / she has hit a big jackpot victory.

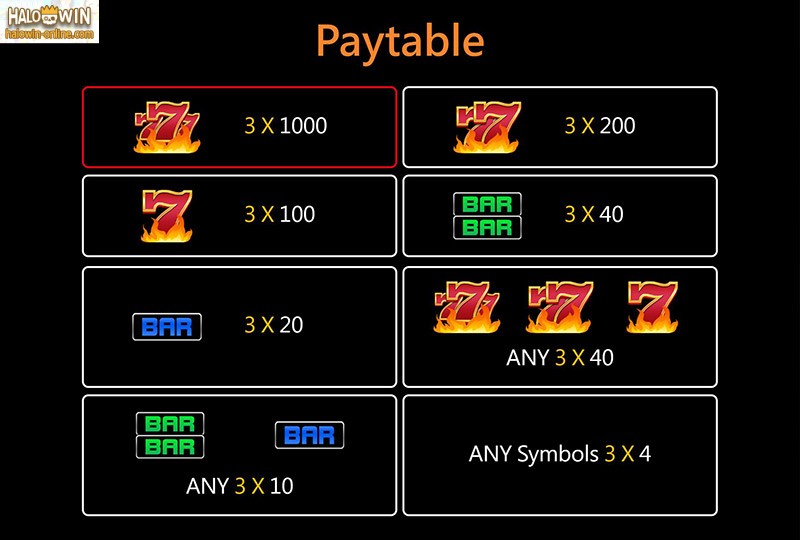

Each credit in mafia wars will cover two pay-lines as critical one can be usually scenario. Based on this, you only need to wager five various.00 credits (pounds or dollars) to cover all 50 lines.

…